Center for Resource Solutions (CRS), through its Green-e® certification programs, certified more than 90 million megawatt-hours in retail transactions in 2020, representing an overall increase of 31% compared to 2019 sales. This is the highest number of certified retail MWh to date, and enough to power four out of five U.S. households for a month.

Summary

Despite the COVID-19 pandemic, Green-e® Energy certified retail sales reached more than 90 million megawatt-hours (MWh) in 2020, the highest number of certified retail MWh to date. CRS currently certifies over 2.5% of the total U.S. electricity mix, or enough to power four out of every five U.S. households for a month. Almost half of the installed wind capacity in the U.S. is participating in Green-e® Energy certified transactions, and 2020 saw over 6.6 million MWh come from solar generation, over 7% more than 2019. Almost half of the energy supplying certified sales came from facilities less than 5 years old.

In 2020 there were over 1.4 million retail purchasers of Green-e® certified renewable energy, including over 104,000 businesses. This is a drop of around 9% from the previous year, which is understandable as the pandemic forced businesses and residential consumers to shift financial priorities. But while 2020 saw a decrease in the overall number of customers of certified utility green pricing products, consumer sales resulted in all-time highs for REC products (including Power Purchase Agreements [PPAs] and Virtual Power Purchase Agreements [VPPAs]) and community choice aggregation products.

As the global retail standard for carbon offset certification, Green-e® Climate brings chain-of-custody oversight to the voluntary offset market. Green-e® Climate provides critical retail protections and assurances for buyers, sellers, and project standards, including confidence in product marketing and overall quality.

Green-e® Climate certified more than 598,700 carbon offsets in 2020, the second highest ever for the program. Additionally, more Green-e® Climate certified offsets were sold into international markets than ever before.

Green-e® Marketplace verifies that the renewable energy purchased or generated by Participants meet the strict environmental and consumer protection standards of the Green-e® Energy certification program, and that each Participant purchases qualifying amounts relative to electricity usage. Green-e® Marketplace licenses the Green-e® logo to Participants for use with their renewable energy claims. Since 1997, the Green-e® logo has served as a nationally recognized symbol to help consumers identify superior, certified environmental commodities.

The total number of Green-e® Marketplace companies participating in 2020 was 26. At the end of 2020, there were approximately 700 products certified by Green-e® Marketplace.

Program Reports

GREEN-E® ENERGY

Green-e® Energy is the leading global certification program for voluntary renewable energy products. Certified products are required to undergo an independent annual audit to demonstrate compliance with the program’s rigorous consumer protection and environmental standards. Sellers of certified renewable energy products are required to provide full and accurate information to their customers, deliver the renewable energy sold with sole title, and source from renewable energy generators that meet the Green-e® Energy program’s resource eligibility requirements, developed by stakeholders and the independent Green-e® Governance Board over nearly 25 years.

As the public’s awareness of the impacts of pollution arising from electricity generation, energy security issues, and sustainable economic development has risen, the demand for renewable energy has increased greatly, as shown here. In fact, voluntary certified renewable energy sales in the U.S. have increased an average of 17% each year since 2016. When the Green-e® Energy program began in 1997, it was the first certification program of its kind, and it remains the leading global renewable energy certification program.

Green-e® Energy Certified Options

Green-e® Energy certified renewable energy products are sold in the following different options:

Green Pricing Programs. Renewable electricity sold by electric utilities in regulated electricity markets, offered in addition to the renewable electricity included in standard electricity service. Includes Green Tariffs offered to larger commercial or industrial customers.

Competitive Renewable Electricity. Similar to a green pricing program, but sold by an electric service provider (ESP) in a deregulated electricity market.

Renewable Energy Certificates (RECs). A REC represents the non-electricity, renewable attributes of one MWh of renewable electricity generation, including all the environmental attributes, and is a tradable commodity that can be sold separately from the underlying electricity. RECs allow for a larger and more efficient national market for renewable energy. The REC product type includes PPAs and VPPAs for which only the REC portion of the purchase is certified.

Community Choice Aggregation. Also known as Municipal Aggregation, CCAs allow cities and counties to aggregate customers in a regulated market within a defined jurisdiction to secure alternative electricity supply contracts on a community-wide basis.

Direct and On-Site Certification. Direct Purchasing is a purchase made directly from renewable generators as an alternative to purchasing from a utility, competitive electricity supplier, or a renewable energy certificate marketer, while On-Site renewable energy is consumed at the same location where it is produced.

Green-e® Energy Participant Overview

329 companies participated in Green-e® Energy in 2020 including 83 sellers offering 93 Green-e® Energy certified REC products, 231 utility green pricing program participants offering 50 certified green pricing programs*, 8 competitive electricity suppliers offering 16 certified renewable electricity programs, 7 Community Choice Aggregation sellers offering 7 products, and 11 entities with 12 different certified Direct or Onsite options.

* Retail Distributors not listed

- 3Degrees Inc.

- 3 Phases Renewables

- AEP Energy, Inc.

- Aggressive Energy

- Alameda Municipal Power

- Algonquin Power

- ALLETE Clean Energy

- Alpha Gas & Electric

- Ambit Energy Holdings, LLC

- Ameren Missouri

- American PowerNet

- Amsterdam Capital Trading B.V. (ACT Commodities Inc.)

- Apple, Inc.

- Austin Energy

- Avangrid (formerly Iberdrola Renewables)

- Azalea Solar, LLC

- Blue Delta Energy, LLC

- Bonneville Environmental Foundation (BEF)

- BP Energy

- Calpine Energy Solutions, LLC

- Carbon Solutions Group (CSG)

- CBL Markets

- Champion Energy Marketing, LLC

- City of Las Vegas, NV

- City of Palo Alto Utilities (CPAU)

- City of San Jose

- Clean Power Alliance (CPA)

- CleanPowerSF

- Clear Energy Brokerage & Consulting, LLC

- Clearway Energy Group

- Clearway Renew LLC

- ClimeCo

- CMS Energy

- Community Energy, Inc.

- Colorado Springs Utilities

- Constellation NewEnergy

- Cypress Creek Renewables

- Direct Energy

- Dominion Virginia Power

- DTE Energy

- Duke Energy

- Dynegy

- East Bay Community Energy (ECBE)

- East Coast Power & Gas, LLC

- ECOHZ

- ECOVE Solar Energy Corporation

- EDF Energy Services

- Engie Generation North America

- ENGIE Resources (formerly Suez Energy Resource NA, Inc.)

- Engie Portfolio Management LLC

- Entergy New Orleans

- Fathom Energy

- Fern Solar LLC

- First Climate Markets

- Green Mountain Energy Company

- Green Power EMC

- Greenburg Traurig, LLP

- Greenlight Energy Group LLC

- Idaho Power Company

- Hero Power

- Indianapolis Power & Light Company (AES)

- J.P. Morgan Ventures Energy Corporation

- JEA

- Just Energy

- Kiwi Energy

- LG&E and KU Energy (formerly E.ON U.S.)

- Liberty Power

- Longroad Energy Services, LLC

- Luminant Energy Company, LLC

- MC Squared Energy Services

- Merrill Lynch Commodities Inc

- MidAmerican Energy Company Energy Trading

- MidAmerican Energy Services

- Moffett Solar 1, LLC

- Mozart Wind LLC

- MP2 Energy

- Muscatine Power & Water

- National Grid Renewables

- NativeEnergy

- Natural Capital Partners

- NextEra Energy Resources, LLC

- Northern Indiana Public Service Company (NIPSCO)

- NRG Business Solutions

- NV Energy

- Pacific Gas and Electric (PG&E)

- PacifiCorp

- PacifiCorp Rocky Mountain

- Peninsula Clean Energy

- Pine Gate Renewables, LLC

- Platte River Power Authority (PRPA)

- PNE Energy Supply, LLC

- Portland General Electric (PGE)

- Powerex Corp

- Puget Sound Energy (PSE)

- Reliant Energy

- Sacramento Municipal Utility District (SMUD)

- San Diego Gas & Electric (SDG&E)

- Santee Cooper

- Schneider Electric (formerly Renewable Choice Energy)

- Seattle City Light

- Shell Energy North America

- Silicon Valley Clean Energy

- Silicon Valley Power – City of Santa Clara (SVP)

- South Plains Wind Energy II, LLC

- Southern California Edison (SCE)

- SP Cactus Flats Wind Energy LLC

- Spring Power and Gas

- Steelcase Inc.

- Sterling Planet, Inc

- Sunwave Gas & Power

- Swiss Carbon Assets

- Talen Energy

- Tennessee Valley Authority (TVA)

- TXU Energy

- United Energy Trading

- Vivorex LLC

- We Energies

- Western Farmers Electric Cooperative

- WGL Energy Services

- WPPI Energy

- Xcel Energy

- X-Elio

Consumer Protection

The Green-e® Energy verification audit and review process protects customers by ensuring that the renewable electricity or RECs purchased and sold by the certified provider meet the environmental and impact-related standards required by the Green-e® Renewable Energy Standard for Canada and the United States (“Standard”), and that they were not sold to more than one customer and only one party has claimed use of that MWh of renewable energy. Replacement RECs are required when supply that has been submitted for verification is ineligible for certification under the Standard. Common reasons for ineligible RECs are double claims (meaning another entity in the chain of custody has claimed to be using the renewable energy) and product-specific restrictions (such as variation from the geographic-proximity requirements of electricity products). In 2020, the Green-e® Energy audit identified a negligible amount of reported supply as ineligible for Green-e® Energy certification which would necessitate procurement of replacement supply by participants. This is due to a sustained market education outreach by Green-e® staff and increased due diligence on the part of Green-e® Energy participants in procuring supply.

Green-e® Climate

Green-e® Climate is the global retail standard for carbon offset certification, bringing chain-of-custody oversight to the voluntary offset market. Green-e® Climate provides critical retail protections and assurances for buyers, sellers, and project standards, including confidence in product marketing and overall quality.

In 2020 the program reported the second-highest total of certified sales in its history. Green-e® Climate certified just over 598,000 mtCO2e (metric tons carbon dioxide-equivalent) in 2020.

Residential purchases of Green-e® Climate certified offsets increased as more retailers of natural gas bundle their gas products with carbon offsets. In 2020, more than 91,000 residential customers purchased certified offsets, an increase of 233%. Still, non-residential customers purchased the vast majority (78%) of certified offsets. Sales of bundled natural gas-carbon offsets accounted for 17% of overall certified sales. Leadership in Energy and Environmental Design (LEED) building certification, which requires Green-e® Climate certification (or equivalent) for offsets to be awarded points for LEED certification, is still a large driver of certified sales, with about 38% of certified sales in 2020 attributed to sales for LEED building certification.

International sales of Green-e® Climate certified offsets continued to be an important segment of sales in 2020. The total volume of international certified carbon offset sales dropped a bit compared to 2019 with about 76,000 mtCO2e. However, the number of countries where certified offsets were sold increased to 22. In 2020 buyers were located in Canada, Chile, China, Finland, France, Germany, Greece, Hong Kong, India, Italy, Ireland, Japan, Korea, Luxembourg, Mexico, Romania, Russia, Serbia, Singapore, Spain, the UAE, and the U.S.

Green-e® Climate Bundled Sales

Share of Certified Sales for LEED Building Certification

2020 once again saw a diverse mix of projects providing carbon offsets to Green-e® Climate certified sales. Overall, 29 different projects supplied offsets to Green-e® Climate certified sales. For the first time, offsets from energy industries provided the majority of supply and were the most-used project type.

MTCO2e by Project Type

Count of Unique Projects by Type

Green-e® Marketplace

Green-e® Marketplace recognizes organizations that use renewable energy and carbon offsets and enables them to demonstrate their environmental commitment to their stakeholders through the use of the internationally recognized Green-e® logo and supporting promotional tools. In 2020, the Green-e® Marketplace program welcomed NuLeaf Naturals, Greenberg Traurig, and Concha y Toro. NuLeaf Naturals is a Colorado-based hemp company that matches 100% of its operations with renewable electricity. Greenberg Traurig, a major international law firm, is certifying RECs through the Green-e® Direct program to match 100% of its U.S. operations. Concha y Toro (below) is Green-e® Marketplace’s first Participant in Chile, with Green-e® certification of the production of the Sunrise brand and other select wines. Overall, Green-e® Marketplace participants purchased or generated approximately 2,346,000 MWh of renewable energy in 2020.

Figures

The charts below are interactive. Click on the items in the legend to change the display.

In 2020, Green-e® Energy certified retail sales totaled over 90 million MWh, an overall increase of 31% compared to 2019 sales. Green-e® Energy certified sales have increased at an average rate of 17% per year over the past four years. Renewable Energy Certificate (REC) sales, either in the form of standalone RECs or in a power purchase agreement or virtual power purchase agreement, continue to drive the majority of certified sales and grew by 36% in 2020. Certified sales through green pricing programs offered by regulated utilities grew by 6% compared to 2019 even while serving fewer customers than the previous few years, mainly because the average residential customer was consuming more electricity while working from home.

Customers in regulated markets purchasing through a Community Choice Aggregation program (CCA) purchased 12% more MWh than in 2019, in line with general growth we’ve seen in CCA programs for the past couple of years. Total certified competitive electricity sales grew by 22%, mostly due to a few one-time large commercial purchases and an increase in consumption by residential customers. Direct and Onsite certified MWh also grew in 2020, from 1 million to 1.4 million certified MWh.

Note: The “RECS, PPAs, and VPPAs” category includes all certified REC transactions, including RECs that are part of PPA and VPPA deals.

Sales by customer type grew about 9% from 2019 for residential customers and 11% for non-residential customers, with the latter accounting for the vast majority of certified MWh purchased at more than 83.2 million MWh, an increase of over a third from the previous year. Megawatt hours sold as certified wholesale transactions increased by 47% from 2019, and residential sales reached more than 6.5 million MWh as more utilities increasingly seek Green-e® Energy certified green pricing options for their customers, and more communities launch their own CCAs. Although there are significantly more residential customers that purchase Green-e® Energy certified renewable energy, they tend to purchase smaller amounts than non-residential customers.

Note: The “RECS, PPAs, and VPPAs” category includes all certified REC transactions, including RECs that are part of PPA and VPPA deals.

2020 saw a decrease in the overall amount of customers purchasing certified retail options for the first time in more than a decade as consumers dealt with the uncertainty of the pandemic. The number of customers enrolled in a certified green pricing option was about 772,000, while the number of customers enrolled in a certified CCA offering was just under 402,000. We did see surprising growth in the number of consumers buying unbundled RECs, which rose by 12% from 2019 to almost 221,000 customers.

Note: The “RECS, PPAs, and VPPAs” category includes all certified REC transactions, including RECs that are part of PPA and VPPA deals.

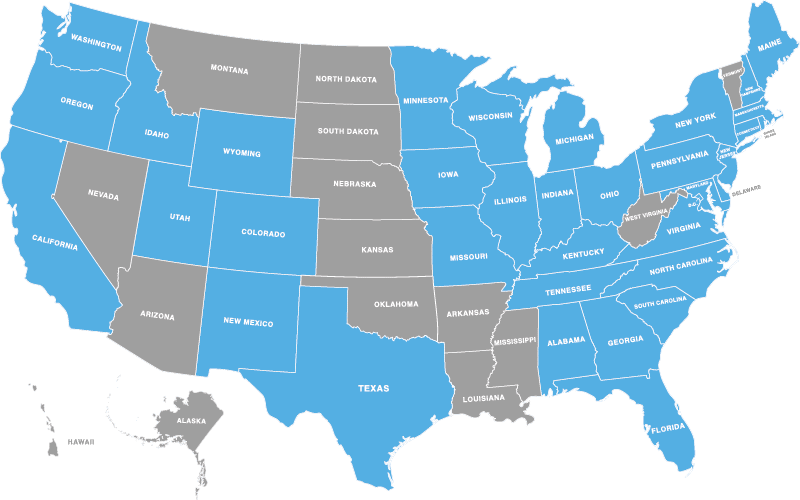

States with Green‑e® Energy Certified Renewable Electricity Options

Many customers throughout the U.S. have the option to purchase Green-e® Energy certified renewable energy through their local utility or electric service provider. In 2020, bundled certified renewable electricity options were available in 32 states and Washington, D.C. RECs unbundled from electricity are available to buyers regardless of location. Businesses purchasing large MWh volumes tend to purchase unbundled RECs, often from multiple locations, while residential customers and businesses purchasing smaller volumes tend to purchase a bundled electricity product available through their utility or electric service provider.

Contributions of Renewable Resource Types to Total Green‑e® Energy Certified Retail Sales

In 2020, Green-e® Energy sales came from a range of resources across the United States and Canada. The resource mix of the voluntary market continues to be wind-dominated in 2020, with wind facilities accounting for 88% of the total supply—a higher share than in previous years and demonstrating a shift away from emitting resources, including biomass. Output from almost half of installed wind facilities in the U.S. is sold in Green-e® Energy certified transactions, based on total capacity.

Solar energy consumption has grown exponentially the past couple of years, and while in terms of MWh output there was 8% more solar MWhs than 2019, solar generation’s overall share of the market fell from 9% in 2019 to 7% in 2020. Solar still represents a significantly higher share of overall grid mix than just a few years ago.

Non-gaseous biomass is 3% of the overall mix, while gaseous biomass, hydro, and geothermal are all 1% or less.

Total Number of Facilities by Resource Type

1,241 unique generation facilities with a total capacity of over 78,000 MW supplied Green-e® Energy certified products in 2020. The number of solar facilities used to supply Green-e® Energy certified products continues to grow. If we count rooftop solar buyback programs offered by electricity providers as one facility for each provider, the number of unique solar facilities utilized in 2020 reached 671 unique facilities, or more than half of all facilities. That said, 2020 saw large growth in an already plentiful amount of wind resources supplying certified sales. Wind by far compromises the majority of overall capacity at just fewer than ¾ of all facilities used to supply Green-e® Energy certified products.

Only new renewables can meet Green-e® Energy standards. In North America, that means eligible renewable facilities must have started operation or have been declared repowered in the last 15 years, or otherwise been approved for extended use in order to provide generation to a Green-e® Energy certified product. In 2020 as in 2019, just under half of the MWh used to supply certified sales came from facilities that were less than five years old, demonstrating consistent turnover of older facilities and how much new build is being used for voluntary purposes.

By number, newer facilities also accounted for a large portion of certified sales in 2020. Facilities five years or younger made about 40% of all facilities that provided any amount of MWh to Green-e® Energy certified sales, which is consistent with 2019. This again illustrates how the voluntary market can drive new build. It may also show the preference of corporate buyers for their investment to be a factor in getting new generation built.

Total Green‑e® Energy Certified Sales of Renewable Energy by Product Type and Customer Type (in MWh)

| Residential (Retail) | Non-Residential (Retail) | Wholesale | |

| RECs, PPAs, and VPPAs | 940,000 | 73,435,000 | 10,106,000 |

| Green Pricing | 4,460,000 | 3,424,000 | |

| Competitive Electricity | 121,000 | 2,976,000 | 5,591,000 |

| Direct | 1,440,000 | ||

| Community Choice Aggregation | 1,479,000 | 1,963,000 | |

| Total Sales | 7,000,000 | 83,238,000 | 15,697,000 |

The total volume of all Green‑e® Energy certified transactions in 2020 reached almost 106 million MWh. This total represents all transactions, including both certified retail sales to electricity end users looking to make a green power use claim, and wholesale sales to resellers of renewable MWh that did not claim the renewable electricity or RECs themselves.

Green-e® Energy certified retail transactions reached 90 million MWh while certified wholesale transactions reached almost 15.7 million MWh in 2020. Of these certified wholesale transactions, around 8 million MWh were resold in certified retail transactions. The remaining 7.7 million MWh were sold in non–certified transactions to utilities, electric service providers, power marketers, and other buyers in the voluntary market.

Removing the instances of renewable MWh certified by Green-e® Energy at both the wholesale and retail levels, certified sales of over 97.9 million unique MWh were made in 2020, an increase of about 20% from 2019 and the highest total of certified unique MWh to date.

Note: The “RECS, PPAs, and VPPAs” category includes all certified REC transactions, including RECs that are part of PPA and VPPA deals.

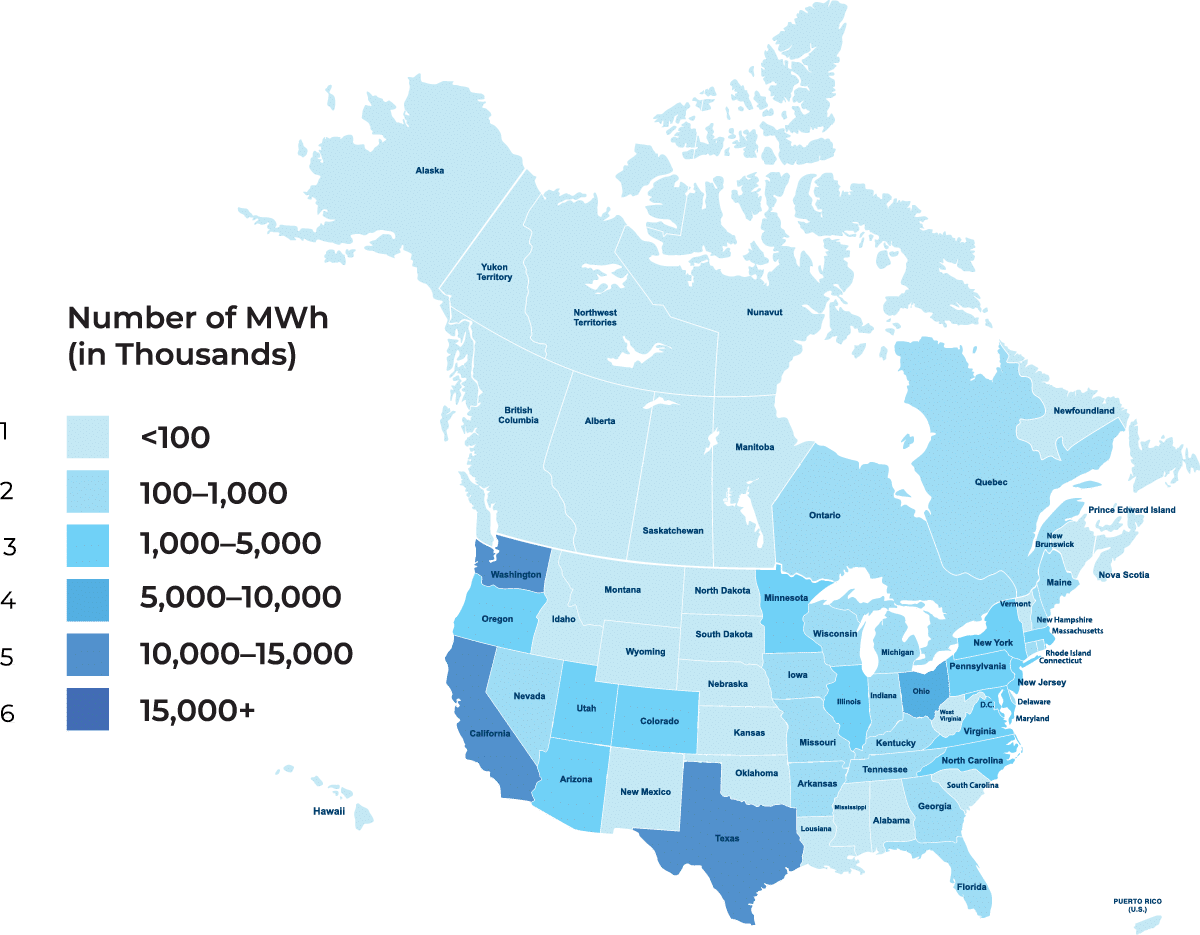

Top 10 States by Retail Sales Volume

| State | % of Total Sales |

| TX | 14% |

| WA | 14% |

| CA | 13% |

| OH | 7% |

| OR | 5% |

| AZ | 4% |

| NY | 4% |

| IL | 3% |

| PA | 3% |

| NJ | 3% |

Green-e® Energy program staff collects data on the number of retail customers by state and the MWh of certified products provided to them. The top 10 states in terms of sales volume have remained relatively constant over the past few years and are typically states with large, sustainable-minded corporate entities. In 2020, Texas became the state with the highest volume of MWh for certified retail sales. The top 10 states represent 72% of the total volume of certified retail sales, the highest number yet seen.

2020 also marked the third year that sales outside of North America were certified, including in Chile and Singapore.

Percent of Total Retail Customers by State (Includes REC Sales)

| State | % of Customers |

| CA | 28% |

| OR | 25% |

| WA | 7% |

| CO | 5% |

| TX | 5% |

| UT | 4% |

| OH | 4% |

| NY | 3% |

| IL | 3% |

| VA | 3% |

Retail customers are buying Green-e® Energy certified renewable energy throughout the U.S. In 2020, 87% of retail customers were located in these top 10 states, with more than half of all customers coming from just two states with successful residential green electricity options: CA and OR. The growth of CCAs saw CA become the state with the most customers in 2020. There is a large degree of overlap between this list and the “Top Ten” retail sales volume list, with the key point of difference in the purchase size of residential and non-residential customers. The states with the highest volumes have more non-residential customers.

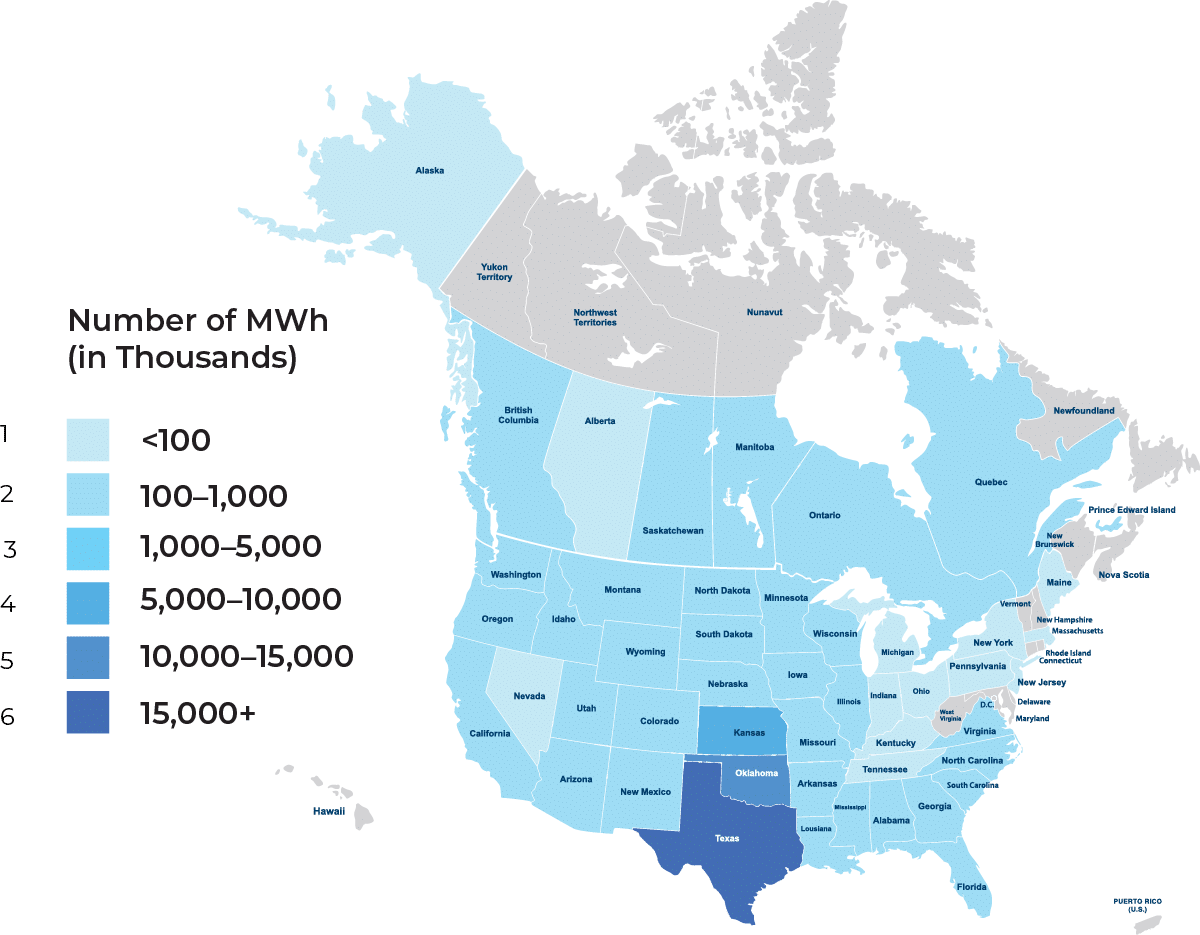

Top Ten States and Provinces Supplying Renewable Energy to Green-e® Energy Certified Retail Sales by Percent of Total Certified MWh

| State/Province | % of Total |

| TX | 37% |

| OK | 15% |

| KS | 7% |

| ND | 5% |

| CA | 4% |

| QC | 3% |

| SD | 3% |

| MN | 2% |

| NE | 2% |

| OR | 2% |

81% of the renewable energy certified by Green-e® Energy was sourced from 10 states. Supply from both Texas and Oklahoma account for 52% of the total supply of renewable electricity certified in 2020, slightly less than 2019. This is primarily related to the high wind content in many certified products, and the high rate of potential for (and installation of) wind facilities in the Midwest and Southern states such as Texas and Oklahoma. The difference between states with generators versus purchasers of renewable energy demonstrates how the market for unbundled RECs is allowing customers with limited access to local renewable energy products to support changes in generation portfolios in the U.S. and Canada.

Green-e® Energy Certified Sales of Renewable Energy Certificates (including PPAs & VPPAs Certified as RECs) by Customer Type

| 2020 Sales (MWh, rounded) | MWh: % Change from 2019 | % of Total Retail REC Sales | Customers | |

| Residential | 940,000 | 19% | 1.3% | 188,000 |

| Non-Residential | 73,435,000 | 35% | 98.7% | 33,000 |

| Total Retail | 74,375,000 | 35% | 100.0% | 221,000 |

| Wholesale | 10,106,000 | -37% | 121 |

Certified REC sales boomed in 2020 with across-the-board growth in terms of total retail REC sales of 35%, driven by large corporate PPA and VPPA deals. The market is still driven by non-residential customers, the number of which increased by 10% from 2019, but there was also a 13% increase in the amount of residential customers purchasing unbundled RECs.

Green‑e® Energy Certified Sales in Green Pricing Programs by Customer Type

| 2020 Sales (MWh, rounded) | MWh: % Change From 2019 | % of Total Green Pricing Sales | Customers | |

| Residential | 4,460,000 | 1% | 57% | 755,000 |

| Non-Residential | 3,424,000 | 13% | 43% | 17,000 |

| Total Retail | 7,884,000 | 6% | 100% | 772,000 |

Many customers can purchase a bundled renewable electricity product from their local electric utility. Utility green pricing programs certified by Green-e® Energy consistently make up the majority of the National Renewable Energy Laboratory’s rankings in terms of customer participation rate, total number of subscribers, total MWh sold, and green power sales as a percentage of total retail electricity sales. In 2020, these programs increased 6% despite a 12% drop in the number of customers. The average purchase size of residential customers climbed to about 6 MWh from 5 MWh, potentially showing the increase in residential consumption resulting from the pandemic. Non-residential customers increased their average purchase by about 50 MWh, which might show a continued commitment to renewables by heavy energy consumers such as data centers. 2020 saw the highest MWh total of Green-e® Energy certified renewable energy sold through green pricing programs ever.

Green‑e® Energy Certified Sales of Electricity by Electric Service Providers by Customer Type

| 2020 Sales (MWh, rounded) | MWh: % Change From 2019 | % of Total Competitive Electricity Retail Sales | Customers | |

| Residential | 121,000 | -5% | 4% | 74,000 |

| Non-Residential | 2,976,000 | 23% | 96% | 4,300 |

| Total Retail | 3,097,000 | 22% | 100% | 78,000 |

In 2020, we saw competitive electricity products purchased by more residential consumers than the previous year, but as in 2019 the overall number of MWh that residential customers purchased actually dropped, this time by 5%. Both of those numbers do not reflect what was observed in the utility green pricing or CCA product categories. We also saw more corporate customers purchasing more MWh in competitive markets like TX, continuing a recent trend.

Green-e® Energy Certified Sales of Community Choice Aggregation Providers by Customer Type

| 2020 Sales (MWh, rounded) | MWh: % Change From 2019 | % of Total CCA Retail Sales | Customers | |

| Residential | 1,479,000 | 15% | 43% | 351,000 |

| Non-Residential | 1,963,000 | 10% | 57% | 50,000 |

| Total Retail | 3,442,000 | 12% | 100% | 401,000 |

Community Choice Aggregation (CCA, also known as Municipal Aggregation) programs allow cities and counties to aggregate customers in a regulated market within a defined jurisdiction to secure alternative electricity supply contracts on a communitywide basis. As more states adopted legislation allowing the establishment of CCAs, the Green-e® Energy program saw an increase in both number of customers and supply. That trend slowed in 2020 as residential participation in certified CCA programs fell by about 12% with non-residential customers falling by 14%, reflecting what we saw with utility green pricing products (and possibly pandemic related). Overall sales for both customer types grew by 15% for residential customers and 10% for C&I customers again, mirroring the decline we saw in utility green pricing products.