Center for Resource Solutions (CRS), through its Green-e® certification programs, certified more than 110 million megawatt-hours in retail transactions in 2021, representing an overall increase of 23% compared to 2020 sales. This is the highest number of certified retail MWh to date, and enough to power four out of five U.S. households for a month.

Summary

Despite the COVID-19 pandemic, Green-e® Energy certified retail sales reached more than 110 million megawatt-hours (MWh) in 2021, the highest number of certified retail MWh to date. CRS currently certifies over 2.8% of the total U.S. electricity mix. More than half of the installed wind capacity in the U.S. is participating in Green-e® Energy certified transactions, and 2021 saw over 11.4 million MWh come from solar generation—73% more than 2020. More than half of the energy supplying certified sales and overall generating capacity came from facilities less than 5 years old.

In 2021, there were 1.3 million retail purchasers of Green-e® certified renewable energy, including almost 309,000 businesses and more than a million residential customers. The pandemic caused some residential consumers to shift financial priorities, resulting in slightly fewer residential customers in 2021. At the same time, we did see a surge in purchasing by commercial and industrial customers, both in terms of the renewable MWh purchased and in number of customers. As people started to return to work, three times more commercial and industrial (C&I) customers purchased certified renewable energy in 2021 than in 2020.

As the global retail standard for carbon offset certification, Green-e® Climate brings chain-of-custody oversight to the voluntary offset market. Green-e® Climate provides critical retail protections and assurances for buyers, sellers, and project standards, including confidence in product marketing and overall quality.

Green-e® Climate certified more than 760,000 carbon offsets in 2021, the highest ever for the program. Additionally, more Green-e® Climate certified offsets were sold into international markets than ever before.

Green-e® Marketplace verifies that the renewable energy purchased or generated by program participants meets the strict environmental and consumer protection standards of the Green-e® Energy certification program, and that each participant purchases qualifying amounts relative to electricity usage. Green-e® Marketplace licenses the Green-e® logo to participants for use with their renewable energy claims.

The total number of companies participating in Green-e® Marketplace in 2021 was 32, with more than 1,000 products certified by the end of the year.

Program Reports

GREEN-E® ENERGY

For over 25 years, Green-e® Energy has been the leading global certification program for renewable energy products sold to consumers and businesses. Certified products are required to undergo an independent annual audit to demonstrate compliance with the program’s rigorous consumer protection and environmental standards. Sellers of certified renewable energy products are required to provide full and accurate information to their customers, deliver the renewable energy sold with sole title, and source from renewable energy generators that meet the Green-e® Energy program’s rigorous resource eligibility requirements.

As the public’s awareness of the impacts of pollution arising from electricity generation, energy security issues, and sustainable economic development has risen, the demand for renewable energy has increased greatly, as shown here. In fact, voluntary certified renewable energy sales in the U.S. have increased an average of 17% each year since 2016. When the Green-e® Energy program began in 1997, it was the first certification program of its kind, and it remains the leading global renewable energy certification program.

Green-e® Energy Certified Options

Green-e® Energy certified renewable energy products are sold in the following different options:

Green Pricing Programs. Renewable electricity sold by electric utilities in regulated electricity markets, offered in addition to the renewable electricity included in standard electricity service. Includes Green Tariffs offered to larger commercial or industrial customers.

Competitive Renewable Electricity. Similar to a green pricing program, but sold by an electric service provider (ESP) in a deregulated electricity market.

Renewable Energy Certificates (RECs). A REC represents the non-electricity, renewable attributes of one MWh of renewable electricity generation, including all the environmental attributes, and is a tradable commodity that can be sold separately from the underlying electricity. RECs allow for a larger and more efficient national market for renewable energy. The REC product type includes PPAs and VPPAs for which only the REC portion of the purchase is certified.

Community Choice Aggregation. Also known as Municipal Aggregation, CCAs allow cities and counties to aggregate customers in a regulated market within a defined jurisdiction to secure alternative electricity supply contracts on a community-wide basis.

Direct and On-Site Certification. Direct Purchasing is a purchase made directly from renewable generators as an alternative to purchasing from a utility, competitive electricity supplier, or a renewable energy certificate marketer. On-Site renewable energy is consumed at the same location where it is produced.

Green-e® Energy Participant Overview

139 companies participated in Green-e® Energy in 2021 including:

- 110 sellers offering 121 Green-e® Energy certified REC products

- 232 utility green pricing program participants offering 53 certified green pricing programs*

- 8 competitive electricity suppliers offering 15 certified renewable electricity programs

- 7 Community Choice Aggregation sellers offering 9 products

- 15 entities with 18 different certified Direct or Onsite options

* Retail Distributors not listed

3Degrees Inc.

3Phases Renewables

AEP Energy, Inc.

AES Indiana (Indianapolis Power & Light Company)

Agendi

Aggressive Energy

Alameda Municipal Power

Algonquin Power & Utilities Corp

ALLETE Clean Energy

Alpha Gas and Electric

Ambit Energy Holdings, LLC

Ameren Missouri

American PowerNet

Amsterdam Capital Trading B.V. (ACT Commodities Inc)

Anew Environmental, LLC

Anza Electric Cooperative, Inc.

Apple Inc.

Austin Energy

Avangrid Renewables

Azalea Solar, LLC

Blue Delta Energy

Bluesource, LLC

Bonneville Environmental Foundation (BEF)

BP Energy

Brookfield Renewable

BTR Energy

Calpine Energy Solutions, LLC

Carbon Solutions Group (CSG)

Champion Energy Marketing, LLC

City of Las Vegas, NV

City of Palo Alto Utilities

City of San Jose

Claro Chile

CleanFuture

Clean Power Alliance of Southern California

CleanPowerSF

Clear Energy Brokerage & Consulting LLC

Clearway Energy Group

Clearway Renew LLC

ClimeCo

CMS Energy Resource Management Company

Colorado Springs Utilities

Community Energy, Inc.

Constellation Energy Services, Inc.

Constellation NewEnergy

Corning Incorporated

Cypress Creek Renewables

Direct Energy

Dominion Energy Virginia

DTE Energy

Duke Energy

Dynegy Energy

East Bay Community Energy (EBCE)

ECOHZ

ECOVE Solar Energy Corporation

EDF Energy Services

Elm Branch Solar 1, LLC

Enel X

Energy Harbor LLC

Engie Energy Marketing NA

Engie North America Inc.

Engie Portfolio Management LLC

ENGIE Resources

Entergy New Orleans

Fathom Energy

Fern Solar LLC

First Climate Markets AG

First Point Power

Freepoint Energy Solutions

GO2 Markets

Golden Omega

Greenberg Traurig, LLP

Greenlight Energy Group LLC

Green Mountain Energy

Green Power EMC

Hero Power

Homefield Energy

Idaho Power Company

J.P. Morgan Ventures Energy Corporation

JEA

Jumpstart

Just Energy

Kiwi Energy

Lenzing Fibers

LG&E and KU Energy

Liberty Power

Longroad Energy

Luminant Energy Company, LLC

MCE (Marin Clean Energy)

MC Squared Energy Services

Merrill Lynch Commodities Inc

MidAmerican Energy Company

MidAmerican Energy Services

Moffett Solar 1, LLC

Mozart Wind LLC

Muscatine Power & Water

National Grid Renewables

Native

Natural Capital Partners

New Brunswick Energy Marketing

NextEra Energy Resources

Northern Indiana Public Service Company (NIPSCO)

NRG Business Solutions

NV Energy

OneEnergy Renewables

Pacific Gas and Electric (PG&E)

PacifiCorp

Patagonia

Peninsula Clean Energy

Pine Gate Renewables, LLC

Platte River Power Authority (PRPA)

PNE Energy Supply, LLC

Portland General Electric (PGE)

Powerex Corp

Puget Sound Energy (PSE)

Reliant Energy Retail Services

Sacramento Municipal Utility District (SMUD)

San Diego Gas & Electric (SDG&E)

Santee Cooper

Schneider Electric

Seattle City Light

Shell Energy North America

Shell Energy Solutions

Silicon Valley Clean Energy (SVCE)

Silicon Valley Power (SVP) – City of Santa Clara

Skyview Ventures

Smart Charging Technologies, LLC

SmartestEnergy

SolRiver Capital

SourceOne

Southern California Edison (SCE)

South Plains Wind Energy II, LLC

SP Cactus Flats Wind Energy LLC

Spring Power and Gas

Spruce Capital &Trading, LLC

Steelcase Inc.

Sterling Planet

STX Commodities

Sunwave Gas & Power

Swiss Carbon Assets

Talen Energy

Tennessee Valley Authority (TVA)

TransCanada Power Marketing Ltd.

TXU Energy

United Energy Trading

Viña Concha y Toro S. A.

Vivorex LLC

Watershed

We Energies

Western Farmers Electric Cooperative

WGL Energy

Xcel Energy

X-Elio

Consumer Protection

The Green-e® Energy verification audit and review process protects customers by ensuring that the renewable electricity or RECs purchased and sold by the certified provider meet the environmental and impact-related standards required by the Green-e® Renewable Energy Standard for Canada and the United States (“Standard”), and that they were not sold to more than one customer and only one party has claimed use of that MWh of renewable energy. Replacement RECs are required when supply that has been submitted for verification is ineligible for certification under the Standard. Common reasons for ineligible RECs are double claims (meaning another entity in the chain of custody has claimed to be using the renewable energy) and product-specific restrictions (such as deviation from the geographic-proximity requirements of electricity products). In 2021, the Green-e® Energy audit identified a negligible amount of reported supply as ineligible for Green-e® Energy certification which would necessitate procurement of replacement supply by participants. This is due to a sustained market education outreach by Green-e® staff and increased due diligence on the part of Green-e® Energy participants in procuring supply.

Green-e® Climate

Green-e® Climate is the global retail standard for carbon offset certification, bringing chain-of-custody oversight to the voluntary offset market. Green-e® Climate provides critical retail protections and assurances for buyers, sellers, and project standards, including confidence in product marketing and overall quality.

In 2021 the program reported the highest total of certified sales in its history. Green-e® Climate certified just over 760,000 mtCO2e (metric tons carbon dioxide-equivalent) in 2021.

Residential purchases of Green-e® Climate certified offsets increased as more retailers of natural gas bundle their gas products with carbon offsets. In 2021, more than 142,800 residential customers purchased certified offsets, an increase of 64%. Still, non-residential customers purchased the vast majority (789) of certified offsets. Sales of bundled natural gas-carbon offsets accounted for 16% of overall certified sales. Leadership in Energy and Environmental Design (LEED) building certification, which requires Green-e® Climate certification (or equivalent) for offsets to be awarded points for LEED certification, is still a large driver of certified sales, with about 38% of certified sales in 2020 attributed to sales for LEED building certification.

International sales of Green-e® Climate certified offsets continued to be an important segment of sales in 2021. The total volume of international certified carbon offset sales increased to 152,000 mtCO2e, and in 2021 buyers were located in: Canada, Chile, China, Finland, France, Germany, Greece, Hong Kong, India, Italy, Ireland, Japan, Korea, Luxembourg, Mexico, Romania, Russia, Serbia, Singapore, South Korea, Spain, the UAE, and the U.S.

Sales of Green-e® Climate Certified Offsets Bundled With Gas

Share of Green-e® Climate Certified Sales for LEED Building Certification

2021 once again saw a diverse mix of projects providing carbon offsets to Green-e® Climate certified sales. Overall, 55 different projects supplied offsets to Green-e® Climate certified sales. Just as in 2020, offsets from energy industries provided the majority of supply while the most-used project type was landfill methane capture.

Percentage of Green-e® Climate Certified MTCO2e by Offset Project Type

Percentage of Unique Offset Projects in Green-e® Climate Certified Sales by Project Type

Green-e® Marketplace

Green-e® Marketplace recognizes organizations that use renewable energy and carbon offsets and enables them to demonstrate their environmental commitment to their stakeholders through the use of the internationally recognized Green-e® logo and supporting promotional tools. In 2021, the Green-e® Marketplace program welcomed Highgate Hotels, Once Upon a Farm, Sephora, TIDAL, and the Wysocki Family of Companies. Overall, Green-e® Marketplace participants purchased or generated approximately 3,111,000 MWh of renewable energy in 2021.

Figures

The charts below are interactive. Click on the items in the legend to change the display.

In 2021, Green-e® Energy certified retail sales totaled 110,607,000 MWh, an overall increase of 23% compared to 2020 sales. Green-e® Energy certified sales increased at an average rate of 17% per year over the past four years. Renewable Energy Certificate (REC) sales—either in the form of standalone RECs, in a power purchase agreement, or in a virtual power purchase agreement—continue to drive the majority of certified sales, and grew by 26% in 2021. Certified sales through green pricing programs offered by regulated utilities grew by 19% compared to 2020, presumably because the average residential customer was consuming more electricity while working from home. However, the effects of high prices in the market and major supply constraints in certain regions of the country impacted sales of competitive electricity and Community Choice Aggregation (CCA) products. With supply in the West being particularly expensive and often already dedicated, CCAs were forced to look outside of their regions to source supply or were unable to give required geographic disclosures to their customers in a timely fashion, rendering them unable to be certified. While sales of competitive electricity products actually increased, this was mainly due to large commercial purchases. At the same time, Direct and On-Site certified MWh spiked in 2021, from 1.44 million to 3.4 million certified MWh, an increase of 139% and another indication that commercial sales drove the market forward in the pandemic years.

Note: The “RECS, PPAs, and VPPAs” category includes all certified REC transactions, including RECs that are part of Power Purchase Agreement (PPA) and Virtual Power Purchase Agreement (VPPA) deals.

In terms of MWh by customer type, sales to residential customers dropped by about 16% from 2020, likely due to pandemic impacts and high REC prices on residential customers. At the same time, sales to non-residential customers grew by about 26%, accounting for the vast majority of certified MWh purchased at more than 104.7 million MWh. This represents almost 80% of the overall market, a higher share than usual. Output from facilities dedicated to specific corporate entities through either PPA or VPPA contracts is likely responsible for this growth. MWh sold as certified wholesale transactions were at 22 million MWh in 2021. Although there are significantly more residential customers that purchase Green-e® Energy certified renewable energy, they tend to purchase smaller amounts than non-residential customers.

Note: The “RECS, PPAs, and VPPAs” category includes all certified REC transactions, including RECs that are part of PPA and VPPA deals.

2021 saw a decrease in the overall amount of customers purchasing certified retail options for the second straight year as consumers dealt with the uncertainty of the pandemic. The number of customers enrolled in a certified green pricing option actually increased in 2021 by 10% to 846,000 customers. The number of customers enrolled in a certified CCA offering fell to just under 50,000 while competitive electricity buyers dropped to almost 21,000 customers. The increase in utility customers versus other customers may demonstrate that utilities are more liquid when navigating the pitfalls of supply constraints than other electricity load serving entities. We did see surprisingly large growth in the number of consumers buying unbundled RECs, which rose by 86% to almost 410,000 customers. it’s likely that many of those new unbundled REC buyers were previously competitive electricity and CCA buyers where the certified product shifted from a certified electricity option to becoming a REC-only product to deal with supply constraints.

A note on CCA customers—We only count CCA customers that actively opt-in to certified programs, not all CCA customers.

Note: The “RECS, PPAs, and VPPAs” category includes all certified REC transactions, including RECs that are part of PPA and VPPA deals, and we only count CCA customers that actively opt into certified programs in these totals, not all CCA customers.

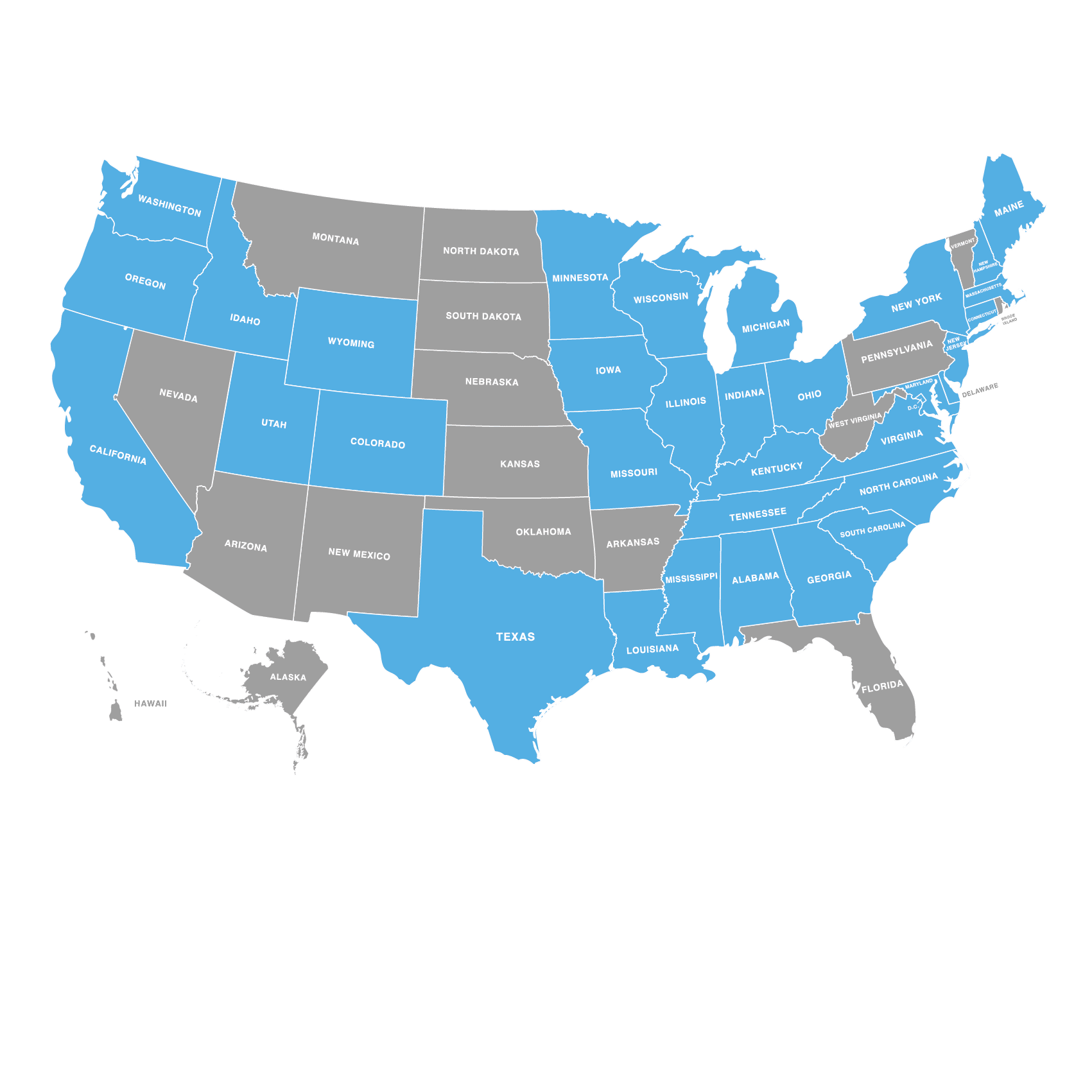

States with Green‑e® Energy Certified Renewable Electricity Options

Many customers throughout the U.S. have the option to purchase Green-e® Energy certified renewable energy through their local utility or electric service provider. In 2021, bundled certified renewable electricity options were available in 33 states and Washington, D.C. RECs unbundled from electricity are available to buyers regardless of location. Businesses purchasing large MWh volumes tend to purchase unbundled RECs, often from multiple locations, while residential customers and businesses purchasing smaller volumes tend to purchase a bundled electricity product available through their utility or electric service provider.

Green-e® Energy also certifies sales in Chile, Taiwan, and Singapore.

Contributions of Renewable Resource Types to Total Green‑e® Energy Certified Retail Sales

In 2021, Green-e® Energy sales sourced from a range of renewable generation across the United States and Canada. The resource mix of the voluntary market is still very wind heavy, with wind facilities accounting for 86% of the total supply—a bit lower than the previous year mainly due to the continued growth of solar. Just five years ago, solar contributed only 250,000 MWh to certified sales, while in 2021 solar provided 11.4 million MWh, an increase of 73% over the previous year. We did see slight growth in non-gaseous biomass and hydro, mainly at the expense of gaseous biomass. Much of the gaseous biomass that was formerly used to generate electricity is now being used in various renewable fuels programs.

Total Number of Facilities by Resource Type

1,200 unique generation facilities with a total capacity of over 78,000 MW supplied Green-e® Energy certified products in 2021. The number of solar facilities used to supply Green-e® Energy certified products continues to grow. Counting rooftop solar buyback programs offered by electricity providers as one facility for each provider, the number of unique solar facilities utilized in 2021 reached more than 600 unique facilities, or half of all facilities used to supply certified sales. 2021 alsdo saw tremendous growth in an already impressive cohort of wind resources supplying certified sales. Wind by far compromises the majority of overall capacity of facilities supply certified sales, with nearly three times more capacity than all other resources combined.

Only new renewables are eligible to meet the criteria in the Green-e Renewable Energy Standard for Canada and the United States. In North America, that means eligible renewable facilities must have started operation or have been declared repowered in the last 15 years, or otherwise been approved for extended use in order to provide generation to a Green-e® Energy certified product. In 2021, more than half of the MWh used to supply certified sales came from facilities that were less than 5 years old at the time. In recent years, that number has usually been at around a third of total facilities. This shows a continued trend of more newly built generators being dedicated to supply the voluntary market rather than being used for other purposes.

In 2021 more than half of the MWh used to supply certified sales came from facilities that were less than five years old, demonstrating consistent turnover of older facilities and how generation from many newly built facilities is being used for voluntary purposes. This is a slightly greater number than in previous years.

Newer facilities accounted for a large portion of certified sales in 2021. Facilities five years or younger comprised over 40% of all facilities that provided any amount of MWh to Green-e® Energy certified sales, which is consistent with previous years. This again illustrates how the voluntary market can drive new build. It may also show the preference of corporate buyers for their investment to be a factor in getting new generation built.

Total Green‑e® Energy Certified Sales of Renewable Energy by Product Type and Customer Type (in MWh)

| Residential (Retail) | Non-Residential (Retail) | Wholesale | |

| RECs, PPAs, and VPPAs | 764,000 | 92,680,000 | 16,461,000 |

| Green Pricing | 4,872,222 | 4,527,000 | |

| Competitive Electricity | 136,000 | 3,474,000 | 5,552,000 |

| Direct | 3,441,000 | ||

| Community Choice Aggregation | 121,000 | 592,000 | |

| Total Sales | 5,893,000 | 104,714,000 | 22,013,000 |

The total volume of all Green‑e® Energy certified transactions in 2021 reached 132 million MWh. This total represents all transactions—including both certified retail sales to electricity end users looking to make a green power use claim, and wholesale sales to resellers of renewable MWh that did not claim the renewable electricity or RECs themselves. Green-e® Energy certified retail transactions reached 110 million MWh, while certified wholesale transactions reached 22 million MWh in 2021. Of these certified wholesale transactions, around 11 million MWh were resold in certified retail transactions. The remaining 19 million MWh were sold in non–certified transactions to utilities, electric service providers, power marketers, and other buyers in the voluntary market. Removing the instances of renewable MWh certified by Green-e® Energy at both the wholesale and retail levels, certified sales of over 121.9 million unique MWh were made in 2021, an increase of about 25% from 2020 and the highest total of certified unique MWh to date.

Note: The “RECS, PPAs, and VPPAs” category includes all certified REC transactions, including RECs that are part of PPA and VPPA deals.

Top 10 States by Retail Sales Volume

| State | % of Total Sales |

| WA | 18% |

| TX | 15% |

| CA | 11% |

| OH | 7% |

| OR | 6% |

| NY | 4% |

| MN | 4% |

| PA | 3% |

| NC | 3% |

| AR | 3% |

Green-e® Energy program staff collects data on the number of retail customers by state and the MWh of certified products provided to them. The top 10 states in terms of sales volume have remained relatively constant over the past few years and are typically states with large, sustainable-minded corporate entities. In 2021, Washington became the state with the highest volume of MWh for certified retail sales. The top 10 states represent 74% of the total volume of certified retail sales, a higher percentage than in past years and the largest percentage to date. 2021 also marked the fourth year that sales outside of North America were certified in Chile, Taiwan, and Singapore.

Percent of Total Retail Customers by State (Includes REC Sales)

| State | % of Customers |

| OR | 29% |

| WA | 9% |

| CA | 8% |

| CO | 6% |

| IL | 6% |

| OH | 6% |

| UT | 5% |

| PA | 5% |

| TX | 5% |

| NY | 3% |

Retail customers are buying Green-e® Energy certified renewable energy throughout the U.S. In 2021, 82% of retail customers were located in these top 10 states. Despite the supply constraints faced in the west, the 3 largest customer bases are the West Coast states – CA, OR, and WA. There is a large degree of overlap between this list and the “Top Ten” retail sales volume list, with the key point of difference in the purchase size of residential and non-residential customers. The states with the highest volumes have more non-residential customers.

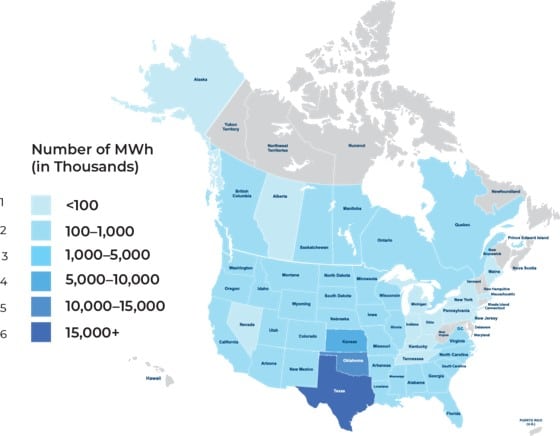

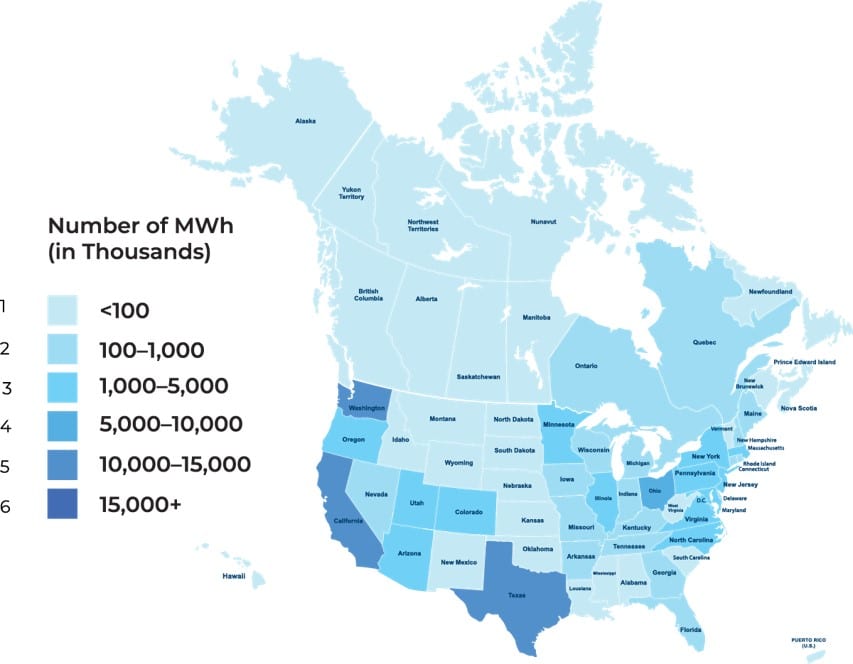

Top Ten States and Provinces Supplying Renewable Energy to Green-e® Energy Certified Retail Sales by Percent of Total Certified MWh

| State/Province | % of Total |

| TX | 39% |

| OK | 15% |

| KS | 8% |

| QC | 5% |

| SD | 4% |

| ND | 3% |

| FL | 2% |

| OR | 2% |

| NE | 2% |

| GA | 2% |

81% of the renewable energy certified by Green-e® Energy was sourced from 10 states. Supply from both Texas and Oklahoma account for 54% of the total supply of renewable electricity certified in 2021, which is a bit less than in 2020. This is primarily related to the high wind content in many certified products, and the high rate of potential for (and installation of) wind facilities in the Midwest and Southern states such as Texas and Oklahoma. The difference between states that supply certified sales versus states that have purchasers of certified sales demonstrates how the market for unbundled RECs is allowing customers with limited access to local renewable energy products to support changes in generation portfolios throughout North America.

Green-e® Energy Certified Sales of Renewable Energy Certificates (including PPAs & VPPAs Certified as RECs) by Customer Type

| 2021 Sales (MWh, rounded) | MWh: % Change from 2020 | % of Total Retail REC Sales | Customers | |

| Residential | 763,000 | -19% | 0.8% | 188,000 |

| Non-Residential | 92,680,000 | 26% | 99.2% | 33,000 |

| Total Retail | 93,444,000 | 35% | 100.0% | 221,000 |

| Wholesale | 22,012,000 | 118% | 121 |

Certified REC sales boomed in 2021 with across-the-board growth in terms of total retail REC sales of 26%, driven by large corporate PPA and VPPA deals. The market is still driven by non-residential customers, a category that increased by an impressive 748% from 2020. At the same time there was a 24% decrease in the amount of residential customers purchasing unbundled RECs. The stunning growth in individual non-residential customers purchasing RECs may reflect smaller businesses, which consume less electricity, increasing participation in the voluntary renewable energy market.

Green‑e® Energy Certified Sales in Green Pricing Programs by Customer Type

| 2021 Sales (MWh, rounded) | MWh: % Change From 2020 | % of Total Green Pricing Sales | Customers | |

| Residential | 4,872,000 | 10% | 52% | 822,000 |

| Non-Residential | 4,527,000 | 45% | 48% | 25,000 |

| Total Retail | 9,399,000 | 24% | 100% | 847,000 |

Many customers can purchase a bundled renewable electricity product from their local electric utility. Utility green pricing programs certified by Green-e® Energy consistently make up the majority of the National Renewable Energy Laboratory’s rankings in terms of customer participation rate, total number of subscribers, total MWh sold, and green power sales as a percentage of total retail electricity sales. In 2021, these programs increased 24% mainly due to a 10% increase in the number of non-residential customers. The average purchase size of residential customers stayed at about 6 MWh, potentially reflecting the increase in residential consumption resulting from the pandemic. Non-residential customers purchased on average 184 MWh, which might show a continued commitment to renewables by heavy energy consumers such as data centers. 2021 saw the highest MWh total of Green-e® Energy certified renewable energy sold through green pricing programs ever.

Green‑e® Energy Certified Sales of Electricity by Electric Service Providers by Customer Type

| 2021 Sales (MWh, rounded) | MWh: % Change From 2020 | % of Total Competitive Electricity Retail Sales | Customers | |

| Residential | 136,000 | 12% | 12% | 20,200 |

| Non-Residential | 3,474,000 | 17% | 88% | 600 |

| Total Retail | 3,610,000 | 17% | 100% | 20,800 |

In 2021, we saw competitive electricity products purchased by more residential consumers than the previous year, but as in 2020 the overall number of MWh that residential customers purchasing actually dropped. Both of those numbers do not reflect what was observed in the utility green pricing or CCA product categories. We also saw more corporate customers purchasing more MWh in competitive markets like TX, continuing a recent trend.

Green-e® Energy Certified Sales of Community Choice Aggregation Providers by Customer Type

| 2021 Sales (MWh, rounded) | MWh: % Change From 2020 | % of Total CCA Retail Sales | Customers | |

| Residential | 121,000 | -92% | 17% | 45,000 |

| Non-Residential | 592,000 | -70% | 83% | 4,600 |

| Total Retail | 713,000 | -79% | 100% | 49,600 |

Community Choice Aggregation (CCA, also known as Municipal Aggregation) programs allow cities and counties to aggregate customers in a regulated market within a defined jurisdiction to secure alternative electricity supply contracts on a community-wide basis. With supply in the West being particularly expensive and many times already dedicated, CCAs were forced to look outside of their regions to source supply or were unable to give required geographic disclosures to their customers in a timely fashion, rendering them no longer qualified for Green-e certification. Due in part to these circumstances, certified CCA sales dropped by 79% in 2021.